INVESTING IN OROKII

We're changing the speed and cost of sending money

orokii.com East Brunswick, NJ

OVERVIEW

Highlights

- Over 3K installed Apps since launch with more than 500 active users.

- Over $150K transaction volume since December 2022

- Experienced team with finance and banking backgrounds from Goldman Sachs and Deutsche Bank.

- Received seven money transmittal licenses and counting.

Financials

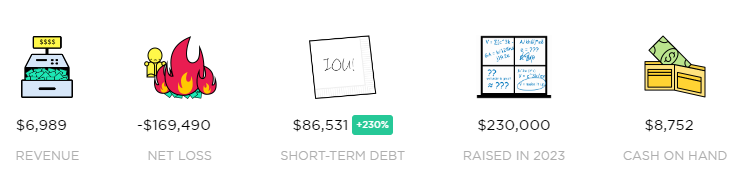

We have financial statements ending December 31, 2023. Our cash in hand is $8,752, as of August 2023. Over the three months prior, revenues averaged $872/month, cost of goods sold has averaged $3,000/month, and operational expenses have averaged $15,000/month.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and the related notes and other financial information included elsewhere in this offering. Some of the information contained in this discussion and analysis, including information regarding the strategy and plans for our business, includes forward-looking statements that involve risks and uncertainties. You should review the “Risk Factors” section for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview

Orokii, Inc. (the Company) is a Fintech startup Company developing a peer-to-peer (P2P) mobile payments solution. The Orokii peer-to-peer (P2P) payment mobile app will enable users to send money to friends and families in the US (domestic) or cross-border (international). Additionally, users will have the ability to request money from friends and families within the US and cross-border. Small and medium-sized enterprises (SMEs) can use the platform to pay invoices domestically and internationally. Capabilities that allow users to donate to not-for-profit organizations, bill pay at restaurants, and rideshares, including the ability to split a bill among friends, will be available in future releases.

Milestones

Orokii, Inc. was incorporated in the State of Delaware in January 2021.

Since then, we have:

- Over 3K installed Apps since launch with more than 500 active users.

- Over $150K transaction volume since December 2022

- Experienced team with finance and banking backgrounds from Goldman Sachs and Deutsche Bank.

- Received seven money transmittal licenses and counting.

- Partner with Facephi, Checkbook, Tempo, Terrapay, Flutterwave, Stellar, TANTV, Payaza, and Plaid.

- Positioned to disrupt the fast-growing $749B remittance market.

The Company is subject to risks and uncertainties common to early-stage companies. Given the Company’s limited operating history, the Company cannot reliably estimate how much revenue it will receive in the future.

Historical Results of Operations

Our company was organized in January 2021 and has limited operations upon which prospective investors may base an evaluation of its performance.

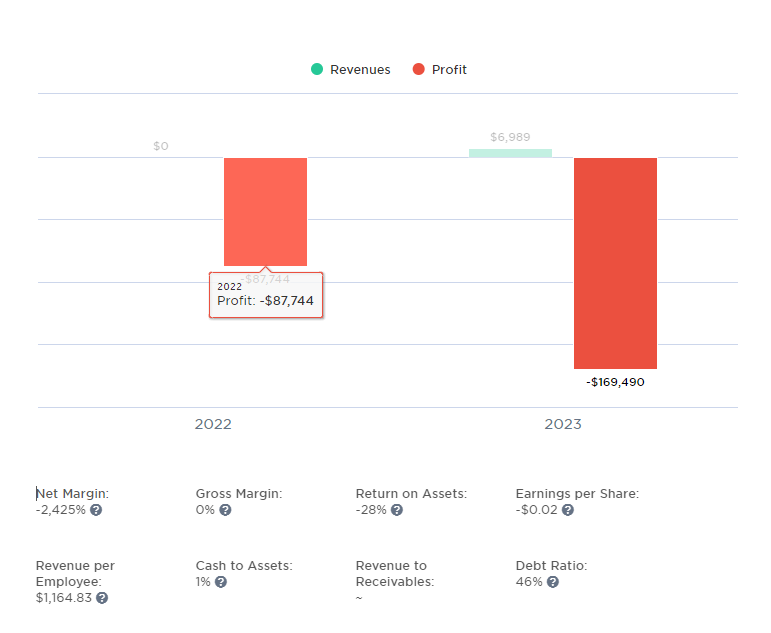

- Revenues & Gross Margin. For the period ended December 31, 2023, the Company had revenues of $6,989 compared to the year ended December 31, 2022, when the Company had revenues of $0.

- Assets. As of December 31, 2023, the Company had total assets of $599,430, including $8,408 in cash. As of December 31, 2022, the Company had $531,152 in total assets, including $826 in cash.

- Net Loss. The Company has had net losses of $169,490 and net losses of $87,744 for the fiscal years ended December 31, 2023 and December 31, 2022, respectively.

- Liabilities. The Company’s liabilities totaled $275,559 for the fiscal year ended December 31, 2023 and $148,756 for the fiscal year ended December 31, 2022.

Related Party Transaction

Refer to Question 26 of this Form C for disclosure of all related party transactions.

Liquidity & Capital Resources

To-date, the company has been financed with $33,000 in equity, $215,000 in capital contributions, and $122,543 in debt.

After the conclusion of this Offering, should we hit our minimum funding target, our projected runway is 3 months before we need to raise further capital.

We plan to use the proceeds as set forth in this Form C under “Use of Funds”. We don’t have any other sources of capital in the immediate future.

At a Glance

Jan 1 – Dec 31, 2023

We will likely require additional financing in excess of the proceeds from the Offering in order to perform operations over the lifetime of the Company. We plan to raise capital in 6 months. Except as otherwise described in this Form C, we do not have additional sources of capital other than the proceeds from the offering. Because of the complexities and uncertainties in establishing a new business strategy, it is not possible to adequately project whether the proceeds of this offering will be sufficient to enable us to implement our strategy. This complexity and uncertainty will be increased if less than the maximum amount of securities offered in this offering is sold. The Company intends to raise additional capital in the future from investors. Although capital may be available for early-stage companies, there is no guarantee that the Company will receive any investments from investors.

Runway & Short/Mid Term Expenses

Orokii, Inc. cash in hand is $8,752, as of August 2023. Over the last three months, revenues have averaged $872/month, cost of goods sold has averaged $3,000/month, and operational expenses have averaged $15,000/month, for an average burn rate of $17,128 per month. Our intent is to be profitable in 17 months.

Since the date our financials cover, we onboarded more users and increased the number of active users making transactions on the Orokii platform. Our transaction volume increased from about $20,000 to over $100,000.

We expect revenues will increase significantly in the next six months. We expect that our expenses will increase by about 20% compared to the current level in the next six months. We expect that our revenue in the next 3-6 months will be between $10K to $20K, while our expenses are expected to be between $45K to $90K. We expect onboarding new users will increase transaction volume and increase revenue. We believe that Orokii will need at least $500,000 to increase its revenue-generating capability significantly.

We are not currently profitable. This is because we are just getting started. We expect to be profitable by December 2024, with revenue forecasted to be $2,713,970. We need $1,000,000 in funding to reach this profitability.

In terms of other available capital, the founder still has funds to continue to bootstrap till the end of the fundraising through Wefunder.

All projections in the above narrative are forward-looking and not guaranteed.

Featured Investor

Jerome Oglesby

Syndicate Lead

“Orokii is a revolutionary remittance platform that delivers its customers the convivence, security and cost efficiencies of sending money with borderless transactions. The innovative technology ensures payments arrive swiftly and securely, all at a radically low cost. Their customers can send domestic and cross- border payments with ease, giving them more time to focus on what truly matters – their goals, their business, and their loved ones. The innovative technology ensures payments arrive swiftly and securely, all at a radically low cost. Their customers can send domestic and cross- border payments with ease, giving them more time to focus on what truly matters – their goals, their business, and their loved ones.”

Other investors include Jerome Oglesby, Dr. Andrew Newton & 14 more

Our Team

Bisi Adedokun | Founder/CEO

Exit a previous startup. Focus on creating value for shareholders and building critical relationships for Orokii.

Mike Tetu | COO

Spent 28 years in the US Army - ran NATO Operations as a Plans officer, and Battalion Commander/Chief Executive Officer.

Joel Alba | CMO

Over 10 years of experience in finance, sales and marketing, campaign management, and client-facing data reporting

Anniekeme Bassey | Growth Marketing Manager

Strategic marketing experience in managing and optimizing campaigns to drive customer acquisition.

Himanshu Sankhe | Product and Pricing Manager

Expert at building pricing algorithms.